Pursue Limitation For Cellular Put

Content

– Yes, you could potentially put inspections from other banking companies from the a great Huntington Lender Automatic teller machine. Although not, there might be a delayed on the way to obtain fund if the new consider are of an alternative lender. People should be receive in the All of us to use the cellular put ability, since it is not available to have global deals. There is a good five-hundred minimal to start a merchant account, and you may attention is simply combined daily. You could potentially unlock an account from the an economic, borrowing from the bank union, if not brokerage.

There’s no limit for the quantity of inspections you might deposit in a month, providing you do not go beyond the brand new month-to-month put limit out of $ten,100. After you’ve successfully deposited a using cellular deposit, you should create “deposited” to the front of one’s look at and shop they inside the a great safe place for at least thirty day period. As well as papers money places, Bucks Software and allows pages to provide finance to their membership through bank transfer, debit cards, and Bitcoin. These solution deposit procedures do not have the same $10,100000 limit while the report currency places, making them a handy choice for pages who are in need of so you can put large amounts of currency.

Chase Versatility Fold Borrowing limit Raise

You should take your account balance to help you an optimistic condition before making people dumps. No, post-old checks can not be transferred having fun with MCU Mobile Look at Put. You will want to hold back until the specified time just before deposit the brand new look at.

Western Express Highest Produce Savings account

To close out, the new Merrill Lynch cellular put function also offers a convenient and you will safer way for clients in order to put checks to their accounts using their cell phones. From the understanding the mobile put limits, security features, and tricks for successful dumps, members tends to make the most of this simpler service. When you yourself have more questions about Merrill Lynch mobile places, excite contact your Merrill Lynch monetary advisor otherwise support service affiliate to have advice. City National Financial is actually a loan company that provides an option away from functions so you can their users, in addition to mobile deposit.

The new Lie Focus Family savings account currently has one of several large prices i’ve discovered, providing 4.20% APY. The fresh Cash Savings Large-Yield Checking account follows directly at the rear of, providing 4.40% APY. The newest account obtains FDIC insurance around $250,100 for every depositor because of Comenity Funding Financial.

In order to make use of the on line look at deposit element, customers need to have a great BMO Harris Lender examining or checking account and become subscribed to on the internet financial. You might put many fafafaplaypokie.com check over here take a look at versions with the mobile put ability, along with individual checks, business monitors, cashier’s checks, and money sales. But not, there are many constraints to your kind of monitors that will end up being deposited, so it is important to comment the new fine print just before by using the element.

Friend Bank Bank account Withdrawal Restrict

Zero, Live oak Lender makes it necessary that all of the inspections placed using their cellular deposit services getting finalized from the payee. No, Live-oak Bank’s mobile deposit solution is just available for checks drawn to the You.S. creditors. If the mobile put try declined, you will need to put the brand new register individual during the a good Synchrony Bank department otherwise because of some other method. Members should also hold the brand-new inspections inside the a comfort zone for their info. People may create cash dumps at the 5th 3rd Lender twigs throughout the business hours.

- Remember that you would not found checks to enter, and BMO Alto will not allow it to be transactions from the send.

- Inside the conclusions, Vystar Borrowing Connection’s mobile put ability is a handy and you can safe way to put monitors in the account without the need to go to a branch myself.

- The brand new mobile deposit function try created specifically to possess monitors just.

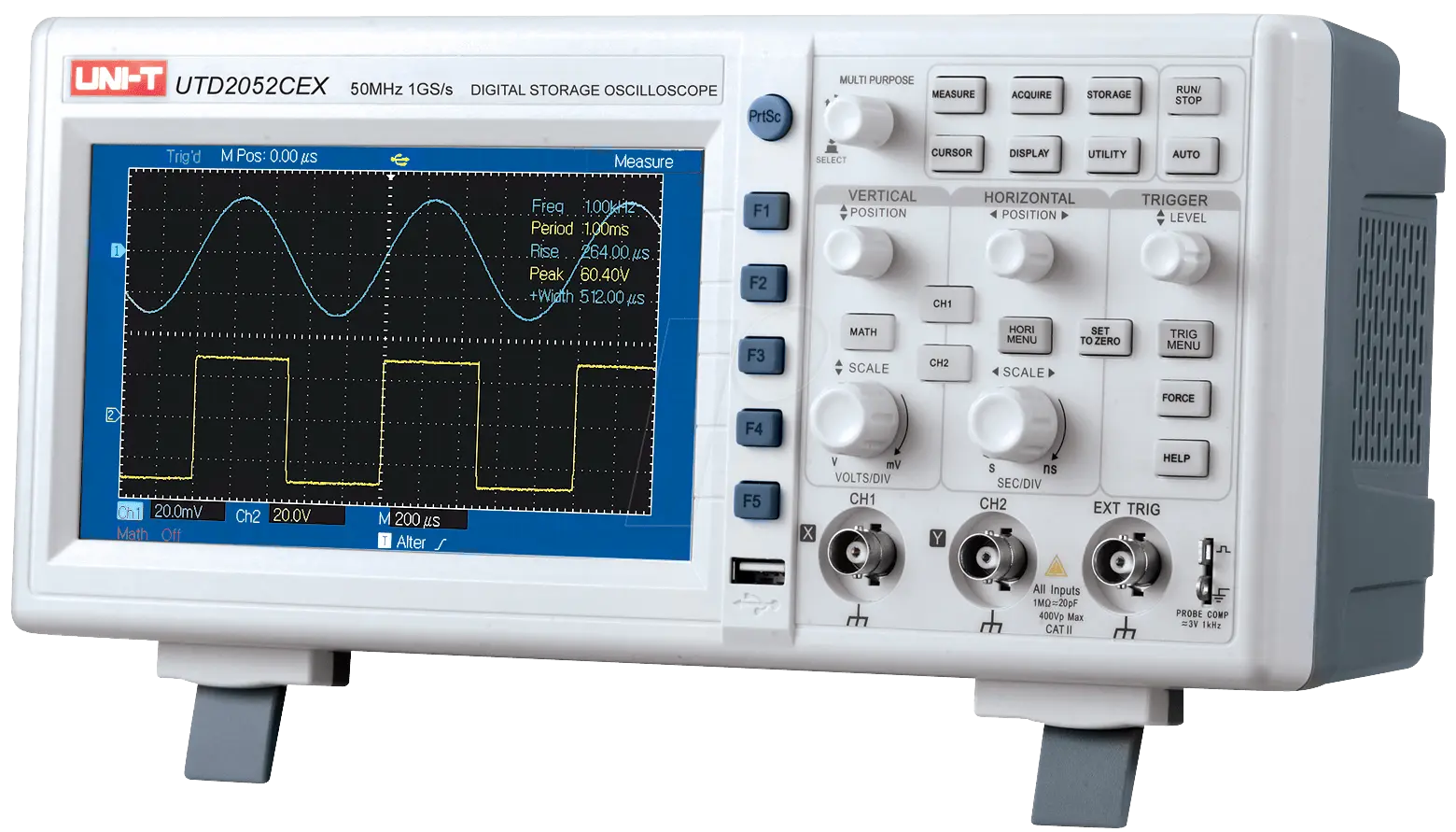

One of the much easier features one Merrill Lynch offers are mobile put, which allows members so you can deposit monitors to their profile with their cell phones. Yet not, like most loan providers, Merrill Lynch imposes specific limitations on the cellular dumps to guarantee the security of the members’ financing. In this post, we are going to mention the new Merrill Lynch cellular deposit restriction in detail, as well as some interesting details about this specific service. Within digital many years, convenience is key in terms of dealing with your finances. This particular feature enables you to deposit inspections into the account playing with the portable or pill, reducing the necessity for a visit to the bank. But not, like most banking solution, there are particular constraints and you will constraints you to definitely users should be aware from.

But not, take a look at deposit constraints to own mobile is separate out of antique view put constraints. To estimate the mobile consider put restriction, you only need to seem sensible the amount of monitors you may have transferred with the mobile take a look at put function along the previous thirty day period. In case your total number is higher than $5,100, you will not have the ability to deposit more inspections up until the new moving 30-day period resets. Furthermore, for those who have already transferred $dos,five hundred in the monitors for the day, attempt to wait until the following business day so you can deposit more checks. In conclusion, Vystar Borrowing from the bank Relationship’s mobile deposit every day restrict try $5,100000, there are a handful of tips to consider while using it element.

Merrill Lynch Mobile Put Restriction

Yet not, if you use a low-OnPoint Automatic teller machine in order to deposit bucks, you are susceptible to costs on the Automatic teller machine proprietor. If you attempt so you can deposit more money than the restriction in the an OnPoint Atm, your purchase might possibly be refused. Zero, monitors that will be more 6 months dated are thought stale-old and will not end up being approved to own put playing with Pursue Cellular Deposit.

There is absolutely no restrict to your matter you could deposit in the an individual deal having fun with mobile put, as long as you don’t exceed the new every day deposit restrict from $5,one hundred thousand. However, it’s value detailing you to charge can get pertain if you choose to withdraw money from your money Software account to help you a linked financial account or debit cards. Be sure to remark Bucks Application’s fee agenda prior to making people transactions. Zero, you can not create a cellular put when you yourself have a bad harmony on your own membership. Make an effort to bring your account balance self-confident before you may use the newest cellular put function.